Impact of Giving

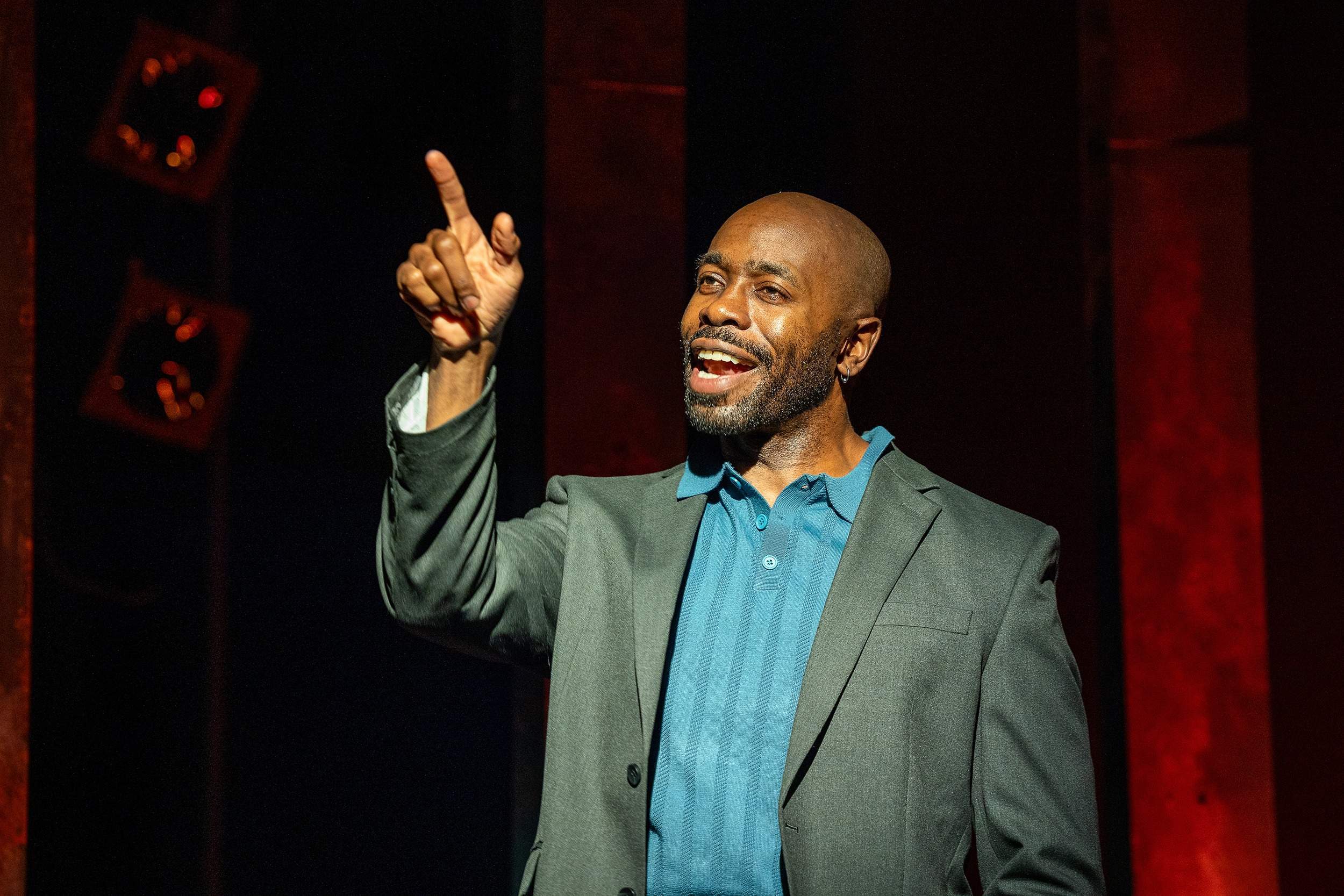

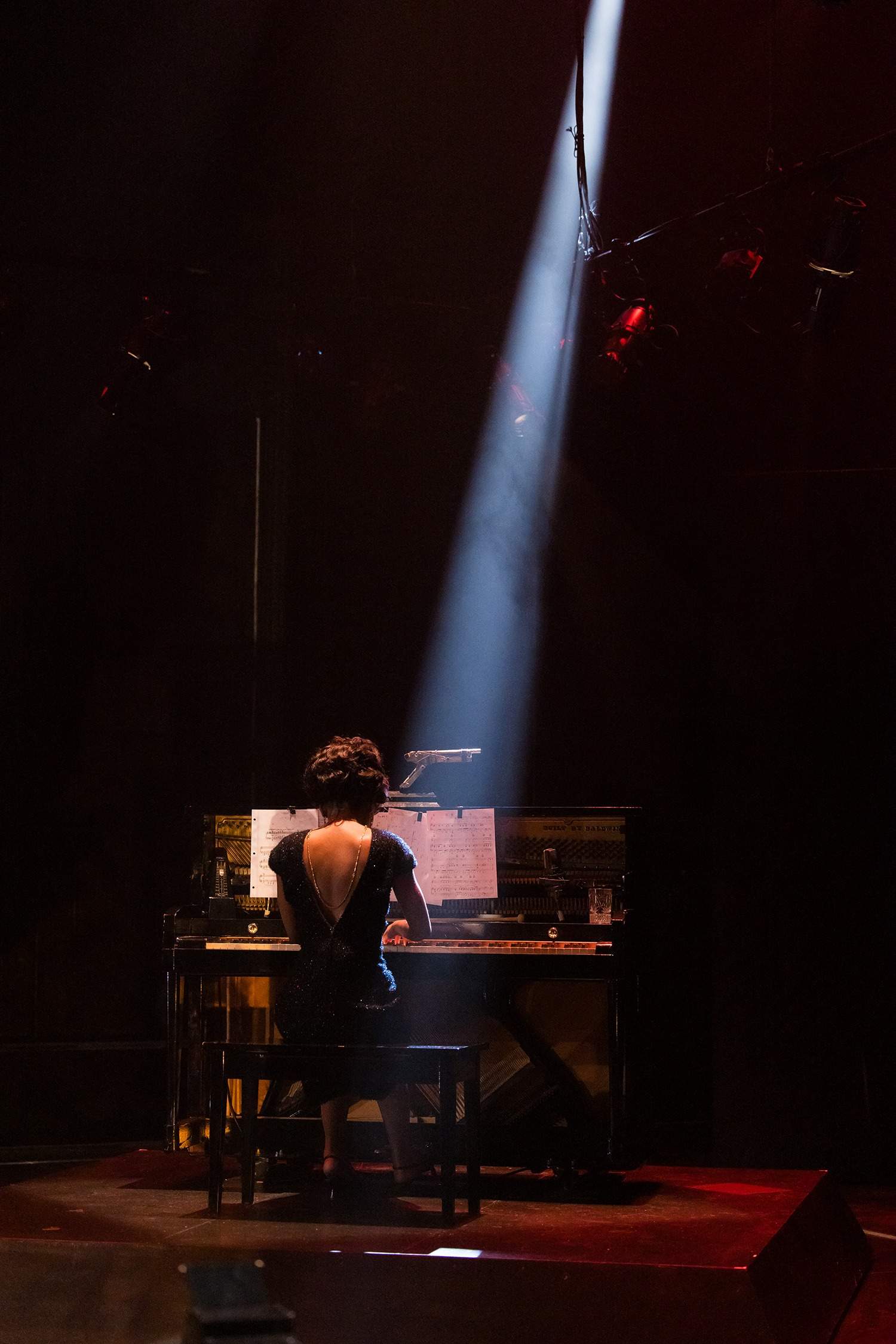

Nonprofit Theatre Needs Friends Like You

Your generous support allows Geva to create world-class theatre right here in Rochester. And there is so much more.

Legacy Society

The Geva Theatre Legacy Society combines your personal financial goals with charitable giving

When you support Geva with a planned gift, you can:

- Realize steady payments through your lifetime and increase spendable income

- Ensure support for a loved one after your lifetime

- Reduce your income, estate and capital gains taxes

- Create a lasting legacy at New York’s most attended regional theatre

These important gifts ensure that Geva will continue to be the Rochester area’s premier theatre and arts education center for generations to come. We invite any friends who have remembered Geva in their estate plans to join the Legacy Society and to formalize their commitment, allowing us to thank you today for your generosity.

Gift Options

Bequests

Leave a legacy by remembering Geva Theatre Center in your will. You can defer a gift of real estate, securities, personal property or cash until after your lifetime. Shelter your heirs from federal estate taxes by designating a specific amount or percentage of the residue for Geva.

Sample Bequest Language: “I give, devise and bequeath to Geva Theatre Center, Inc. (EIN: 23-7202906) of Rochester, New York the sum of $____ [or ____% of the residue of my estate, both real and personal], to be held, administered, and used by Geva Theatre Center for the unrestricted support of the area of greatest need at the time the gift is received. I instruct that all my charitable gifts shall be made, to the extent possible, from property that constitutes ‘income in respect of a decedent’ as that term is defined in the Internal Revenue Code.”

Gift Options

Charitable Gift Annuities

Consider a high-yield, tax-deductible gift annuity. By making a gift of cash or other qualifying asset and entering into a gift annuity agreement naming Geva Theatre Center as the beneficiary, you can receive guaranteed payments for life. These payments will not change regardless of future interest rate fluctuations.

Gift Options

Life Insurance

You can donate a life insurance policy to us or simply name us as the beneficiary. For the gift of a fully paid policy, you will receive an income tax deduction equal to the lesser of the cash value of the policy or the total premiums paid. You must name us as owner or beneficiary of an existing policy in order to qualify for the federal charitable contribution deduction.

Retirement Assets

Avoid the two-fold taxation on IRAs or other benefit plans by naming Geva Theatre Center as the beneficiary of the remainder of the assets after your lifetime. If you are over the age of 70 1/2, you may be able to roll over up to $100,000 from an individual retirement account (IRA) directly to Geva without recognizing the assets transferred to Geva as income.

Charitable Remainder Unitrust

Create a hedge against inflation over the long term by creating a trust that pays you a fixed percentage of the trust’s assets as revalued annually.

Gift Options

Charitable Lead Trust

Reduce gift and estate taxes on assets you pass to your heirs by creating a charitable trust that pays fixed or variable income to Geva for a specific term of years, with the principal retained for your heirs.

This information does not constitute legal or tax advice. For more information on Planned Giving, please consult your attorney or accountant or contact our Director of Institutional Advancement at (585) 420-2041.